S&P Futures

6,995.00 (+0.17%)

Dow Futures

50,280.00 (+0.12%)

Nasdaq Futures

25,392.00 (+0.15%)

Russell 2000 Futures

2,703.60 (+0.28%)

Crude Oil

64.59 (+0.36%)

Gold

5,071.90 (-0.15%)

Silver

82.18 (-0.07%)

EUR/USD

1.1923 (+0.02%)

10-Yr Bond

4.1980 (-0.19%)

VIX

17.31 (-0.29%)

GBP/USD

1.3674 (-0.13%)

USD/JPY

155.2940 (-0.34%)

Bitcoin USD

69,327.78 (-0.58%)

XRP USD

1.43 (+1.89%)

FTSE 100

10,353.29 (-0.32%)

Nikkei 225

57,650.54 (+2.28%)

World Indices

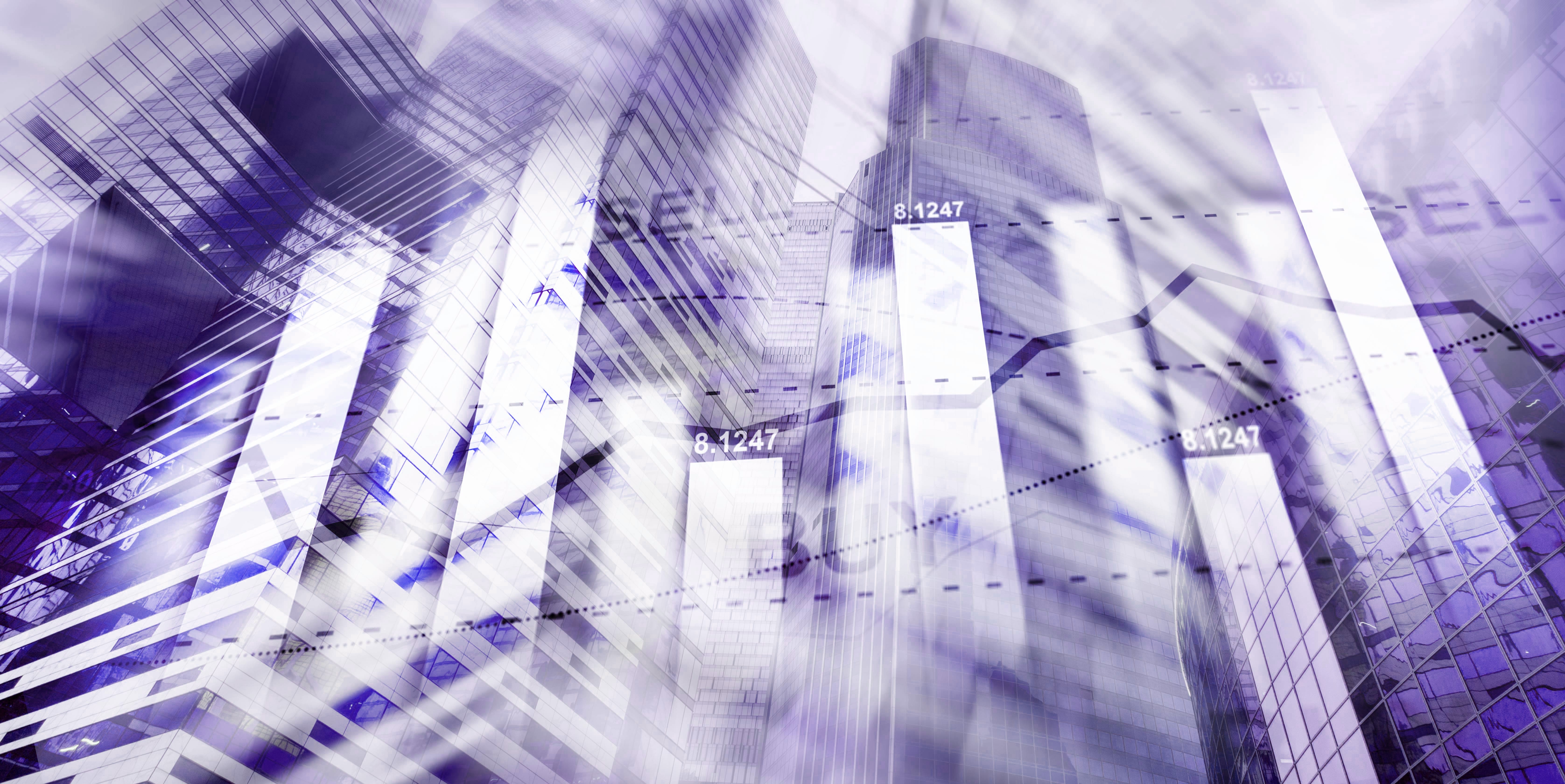

| Symbol | Name | Price | Change | Change % | Volume |

|---|---|---|---|---|---|

| ^GSPC | S&P 500 | 5,675.12 +36.18 (+0.64%) | +36.18 | +0.64% | 2.984B |

| ^DJI | Dow Jones Industrial Average | 41,841.63 +353.44 (+0.85%) | +353.44 | +0.85% | 564.198M |

| ^IXIC | NASDAQ Composite | 17,808.66 +54.58 (+0.31%) | +54.58 | +0.31% | 5.578B |

| ^NYA | NYSE COMPOSITE (DJ) | 19,494.71 +263.36 (+1.37%) | +263.36 | +1.37% | 0 |

| ^XAX | NYSE AMEX COMPOSITE INDEX | 5,038.96 +99.26 (+2.01%) | +99.26 | +2.01% | 0 |

| ^BUK100P | Cboe UK 100 | 867.52 +4.72 (+0.55%) | +4.72 | +0.55% | 0 |

| ^RUT | Russell 2000 | 2,068.33 +24.24 (+1.19%) | +24.24 | +1.19% | 0 |

| ^VIX | CBOE Volatility Index | 20.51 -1.26 (-5.79%) | -1.26 | -5.79% | 0 |

| ^FTSE | FTSE 100 | 8,680.29 +47.96 (+0.56%) | +47.96 | +0.56% | 0 |

| ^GDAXI | DAX P | 23,154.57 +167.75 (+0.73%) | +167.75 | +0.73% | 0 |

| ^FCHI | CAC 40 | 8,073.98 +45.70 (+0.57%) | +45.70 | +0.57% | 0 |

| ^STOXX50E | EURO STOXX 50 I | 5,445.55 +41.37 (+0.77%) | +41.37 | +0.77% | 0 |

| ^N100 | Euronext 100 Index | 1,595.03 +14.15 (+0.90%) | +14.15 | +0.90% | 0 |

| ^BFX | BEL 20 | 4,477.95 +67.83 (+1.54%) | +67.83 | +1.54% | 0 |

| MOEX.ME | Public Joint-Stock Company Moscow Exchange MICEX-RTS | 85.20 -0.11 (-0.13%) | -0.11 | -0.13% | 1.576M |

| ^HSI | HANG SENG INDEX | 24,573.82 +428.25 (+1.77%) | +428.25 | +1.77% | 0 |

| ^STI | STI Index | 3,906.83 +47.47 (+1.23%) | +47.47 | +1.23% | 0 |

| ^AXJO | S&P/ASX 200 | 7,857.90 +3.80 (+0.05%) | +3.80 | +0.05% | 0 |

| ^AORD | ALL ORDINARIES | 8,087.70 +5.60 (+0.07%) | +5.60 | +0.07% | 0 |

| ^BSESN | S&P BSE SENSEX | 75,050.16 +880.20 (+1.19%) | +880.20 | +1.19% | 0 |

| ^JKSE | IDX COMPOSITE | 6,076.08 -395.87 (-6.12%) | -395.87 | -6.12% | 0 |

| ^KLSE | FTSE Bursa Malaysia KLCI | 1,527.81 +15.66 (+1.04%) | +15.66 | +1.04% | 0 |

| ^NZ50 | S&P/NZX 50 INDEX GROSS ( GROSS | 12,076.85 -89.29 (-0.73%) | -89.29 | -0.73% | 0 |

| ^KS11 | KOSPI Composite Index | 2,610.06 -0.63 (-0.02%) | -0.63 | -0.02% | 445,267 |

| ^TWII | TWSE Capitalization Weighted Stock Index | 22,246.26 +127.63 (+0.58%) | +127.63 | +0.58% | 0 |

| ^GSPTSE | S&P/TSX Composite index | 24,785.11 +231.71 (+0.94%) | +231.71 | +0.94% | 331.049M |

| ^BVSP | IBOVESPA | 130,833.96 +1,876.87 (+1.46%) | +1,876.87 | +1.46% | 0 |

| ^MXX | IPC MEXICO | 52,484.28 +607.18 (+1.17%) | +607.18 | +1.17% | 0 |

| ^IPSA | S&P IPSA | 7,601.82 +92.82 (+1.24%) | +92.82 | +1.24% | 0 |

| ^MERV | MERVAL | 2,346,305.50 +10,730.75 (+0.46%) | +10,730.75 | +0.46% | 0 |

| ^TA125.TA | TA-125 | 2,591.61 -6.47 (-0.25%) | -6.47 | -0.25% | 0 |

| ^CASE30 | EGX 30 Price Return Index | 31,458.60 +120.30 (+0.38%) | +120.30 | +0.38% | 0 |

| ^JN0U.JO | Top 40 USD Net TRI Index | 4,827.82 +56.22 (+1.18%) | +56.22 | +1.18% | 0 |

| DX-Y.NYB | US Dollar Index | 103.52 +0.15 (+0.15%) | +0.15 | +0.15% | -- |

| ^125904-USD-STRD | MSCI EUROPE | 2,295.80 +28.97 (+1.28%) | +28.97 | +1.28% | -- |

| ^XDB | British Pound Currency Index | 129.90 +0.56 (+0.44%) | +0.56 | +0.44% | 0 |

| ^XDE | Euro Currency Index | 109.20 +0.32 (+0.29%) | +0.32 | +0.29% | 0 |

| 000001.SS | SSE Composite Index | 3,426.43 +0.30 (+0.01%) | +0.30 | +0.01% | 1.225B |

| ^N225 | Nikkei 225 | 37,908.20 +511.68 (+1.37%) | +511.68 | +1.37% | 0 |

| ^XDN | Japanese Yen Currency Index | 67.02 -0.26 (-0.39%) | -0.26 | -0.39% | 0 |

| ^XDA | Australian Dollar Currency Index | 63.84 +0.60 (+0.96%) | +0.60 | +0.96% | 0 |

News

Jessica Ling, EVP of global advertising at American Express, discusses how Amex is redefining "premium" from a status symbol to access to cultural, travel, dining, and sports experiences, particularly for Gen Z and Millennials. She emphasizes leveraging the brand's heritage of trust and service while driving modern relevance through cultural experiences and personalization. The article also touches on the brand's integrated media strategy and preparations for AI-led commerce.

C.H. Robinson Worldwide, Inc. (Nasdaq: CHRW) announced its fourth quarter 2025 earnings release will be issued after market close on Wednesday, January 28, 2026. The company will host a conference call at 5:30 p.m. Eastern Time on the same day to discuss results and answer investor questions. A simultaneous audio webcast and presentation slides will be available on their investor relations website.

Several semiconductor stocks, including Analog Devices, Applied Materials, KLA Corporation, Monolithic Power Systems, and onsemi, surged in value, driven by a broader market rally fueled by optimism in artificial intelligence and big tech shares. This momentum was also supported by hopes for an easier monetary policy from the Federal Reserve. Analog Devices, in particular, reached a new 52-week high, demonstrating significant investor returns over the past five years.

Several semiconductor stocks, including Microchip Technology, NXP Semiconductors, Texas Instruments, Western Digital, and Allegro MicroSystems, saw significant gains following a broader market rally driven by optimism in AI and tech. The market's positive momentum was also fueled by hopes for easier monetary policy from the Federal Reserve. Western Digital, in particular, benefited from strong demand for data storage solutions tied to the AI sector.

.jpg)

Abidur Chowdhury, formerly an Apple Inc. designer who contributed to the iPhone Air, has been appointed head of design at AI startup Hark. This move is part of Hark's aggressive recruitment strategy to attract top Silicon Valley talent, with the company already having hired engineers from tech giants like Google, Meta Platforms, and Amazon. Hark, founded by serial entrepreneur Brett Adcock, is self-funded with $100 million and aims to expand its engineering team significantly while developing its first AI model for release in summer 2026.

.png)

AMD CEO Lisa Su stated that demand for AI is "going through the roof" and that the cost of individual AI chips can be tens of thousands of dollars. She explained that AMD's AI systems bundle dozens of these high-end chips and companies need massive investments in computing power to remain competitive in the AI market. Su projected that the world will need "10 yottaflops" of computing power in the coming years to keep up with AI's rapid growth.

Bragar Eagel & Squire, P.C., a shareholder rights law firm, reminds investors that class action lawsuits have been filed against Blue Owl Capital, Inc. (NYSE:OWL), Gauzy Ltd (NASDAQ:GAUZ), and Alexandria Real Estate Equities, Inc. (NYSE:ARE). The firm encourages investors in these companies to contact them to potentially serve as lead plaintiff. The lawsuits allege that the respective companies made materially false and/or misleading statements regarding their business operations and prospects.

Establishment Labs (ESTA) is gaining buzz for its high-tech breast implants and surgical technology, sparking debate about whether it's a game-changer or just niche hype. While the company offers innovative, premium products in a regulated industry, investors need to weigh its significant growth potential against substantial risks like market volatility and regulatory challenges. It's considered a high-risk, high-conviction play rather than a quick flip, appealing to investors comfortable with significant stock swings and a long-term outlook.

Allegro MicroSystems (ALGM) shares rose approximately 10% after Wells Fargo added the stock to its Q1 2026 Tactical Ideas list with a $40 target, citing expected improvement in leading indicators. The company also announced two new product launches targeting SiC power designs for AI data centers and electric vehicles, further boosting investor confidence. These developments are seen as indicators that the chip supply chain's inventory overhang may be easing, alongside a broader market warming to analog chip names.

Western Digital (WDC) shares surged 17%, trading above $219 after Nvidia CEO Jensen Huang's CES remarks about "context memory storage" sparked an AI-driven rally among storage and memory companies. This jump reflects investor optimism about demand for data storage tied to AI data centers, with other companies like SanDisk, Seagate Technology, and Micron also experiencing significant gains. However, analysts caution that current high prices might not be sustainable long-term, and upcoming U.S. labor data could influence market expectations and tech trades.

-0.07%

-0.07%  +0.12%

+0.12%